Digital innovation in rural financial services has the potential to be a game changer for achieving sustainable agriculture and global growth. Smallholder farmers and small enterprises in developing countries often lack the required investment capital and access to financial services, as well as the digital and financial literacy necessary for success. This webinar, organized by CRS and NetHope, featured speakers from FIT Insights Group (aka Infotrade Maalicard), GSMA, the Food and Agriculture Organization of the United Nations (UN FAO), and Catholic Relief Services (CRS). Below is a brief summary of what was discussed.

Robert M. Kintu, CEO – FIT Insights Group, discussed the digital trends and innovations for financial inclusion of smallholder farmers in Uganda and new innovations for farmers. One of the new digital finance options is the use of agency banking. Agency Banking (or branchless banking) is a means for a traditional bank to cost effectively extend its branch network through the use of authorized agents. This enables the bank to provide low-risk services to customers in remote and rural areas that are difficult to service using traditional branches. People in rural Uganda, who are unable to access brick and mortar banks, are adopting agency banking to access their accounts through digital services. According to Robert, mobile money is now commonly used, and more people are embracing digital wallets as a means of receiving funds and making payments. This shift from cash, is in the interest of the Bank of Uganda, as Regulators want to drive the widespread use of the digital financial services. Agency services provide a way for people to make payments and avoid the problems when people keep money in their homes. Community based savings organizations such as Savings and Credit Cooperative Organization (SACCO) and Village Savings and Loan Associations (VSLAs) are adopting cashless money collection and using digital services to access remittances and this is stimulating the growth of the Mobile plus payment solution. This allows the members of the groups to send money directly to banks without having to travel. Rural farmers are particularly interested in building credit; however, it is often difficult to do so without enough information about them. Digital payments to banks through the agency system are a step in the right direction for financial inclusion.

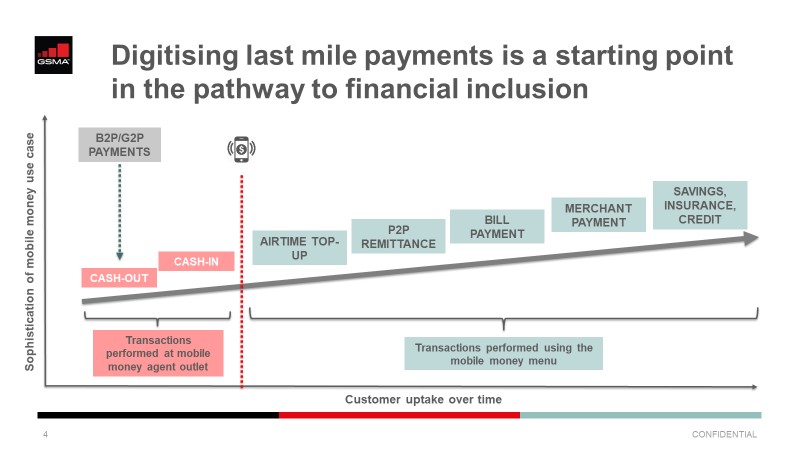

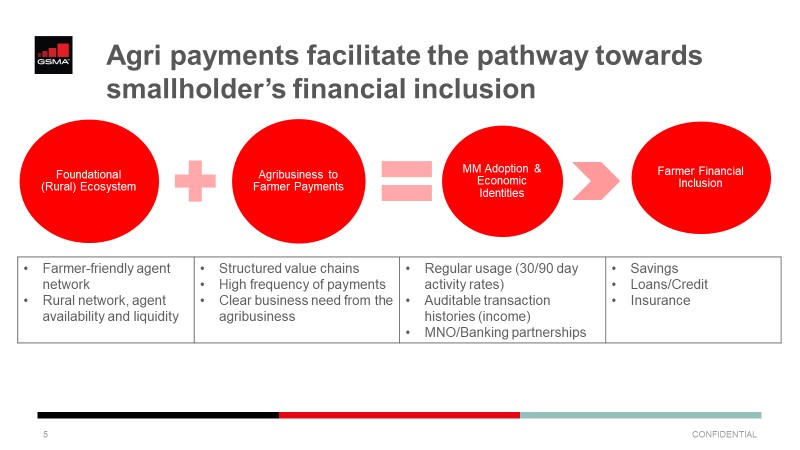

Matthew Strickland, Senior Market Engagement Manager, Mobile for Development – GSMA, explained how digitizing smallholder payments facilitates the pathway towards financial inclusion. Agriculture is the main cash flow for the rural communities in developing countries, but cash payments can be risky and managing large numbers of small cash transactions are costly for both agribusinesses and farmers. Digital money options provide an entry point for more efficient financial inclusion for smallholder farmers. There is also the added advantage that mobile technology creates an economic identifier that captures farmer data over time, e.g. life events, assets, transaction history. These digital footprints can be collated into a form of “transaction historyâ€, similar to a type of “credit history†albeit with different attributes. As farmers build their digital history, the various transactions can be assessed in terms of risk, and can be used to open the door to financial inclusion for farmers and could give them access to credit, leases, savings, etc.

Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â

Valeria Pesce, Information Management Specialist – FAO UN, spoke about e-Learning and capacity building on farmers’ data, with a focus on the recently developed online course on Farm Data Management, Sharing and Services for Agriculture Development. The primary audience for this course is farmers organizations, cooperatives, NGOs and business development services such as agricultural input suppliers, financial service providers, etc. The course aims to raise awareness among farmers about the value of sharing their data and highlights the rights that farmers have to their data. Finally, development agencies can get great use out of the course as they often are advising farmers on what are best practices surrounding data management and sharing. On the whole, capacity building through online courses such as the one Valeria described will help to build trust between the farmers and financial institutions.

Last, but certainly not least, we have Shaun Ferris, Technical Director for Agriculture and Livelihoods – CRS, who discussed the main lessons learned when designing and implementing digital financial solutions for smallholder farmers. The first point being that financing remains a critical gap in the way that we do value chain development. We need much more technical support for all of the actors involved – NGOs working with digital services providers and the banking system to make sure that the financing is being provided to people who know how to use it effectively. Shaun goes on to say that the clever thing we are seeing with the digital approach is how it is being adapted to meet the complicated and diverse needs of the agricultural sector. Traditionally, financial institutes have tried to standard urban financial instruments for agricultural markets which have largely failed. Digital methods offer providers a way to adapt the financial instrument to the specific needs of an agricultural value chain, which is much more attractive to farmers and their support services. If digital systems can be used to identify the client and their needs more clearly, this enables lenders to design financial products, which target the right type of market and the client. This level of precision provides us with a much better way of de-risking these complicated markets and enables us to learn how to finance specific types of value chains and client groups. The key message here is that we need to use the digital apparatus at our disposal to get the right types of tools to the right types of clients.

Following the responses of each of our four presenters, a stimulating discussion was broached on the topics of capacity building for farmers, financial identification, data sharing, de-risking and building trust. Anyone who has used a You Tube video knows how effective microlearning videos and online courses can really help learning. This idea is now being used to help build the capacity of farmers and help them to see what others are doing that they can watch, repeat and share with others. Financial lessons also should be included in this type of learning, so that more farmers can take advantage of mobile money systems. Ideas such as build digital farmer profiles, that combine production data, input use and sales need to be better managed, so that farmers, co-ops and agribusinesses can use this information to access credit, leases, loans, etc. This information can also be shared with Governments, to help with service support and planning. However, the value of shared data, will not be realized without building trust. Trust between financial institutions, agribusiness owners and smallholder farmers. Trust needs to be built between the farmers and those who would use their data. Farmers need to know, the what, why, and how their data will be used – and also have a much better understanding about their rights associated with their data. Trust in the system will facilitate the collection of more accurate information and greater sharing of information within the digital financial market, if all see and share the benefits.

There are several ethical and legal issues that are not yet covered by legislation. There is always confusion about what can and cannot be shared when it comes to working with diverse sets of people, and there are now efforts being made to develop digital codes of conduct – at both the national and international levels. At present, farmers’ organizations and agribusinesses are coming together to draft best practices that pay particular attention to protecting farmer rights. Protecting farmers will help to build their trust, which will make them more willing to share information to build their economic profiles.

The more robust the economic profile of a farmer, the better the chances that formal financial institutions will provide them with access to the investment capital they need to access the services that will grow their businesses. Finally, it is essential that the farmers have the digital and financial literacy required for success – or all of this will have been for naught.

By: Paul S Wiedmaier

ICT4D Knowledge Management

Catholic Relief Services